Be Part of the Next Breakout Oil Story in Namibia’s Orange Basin

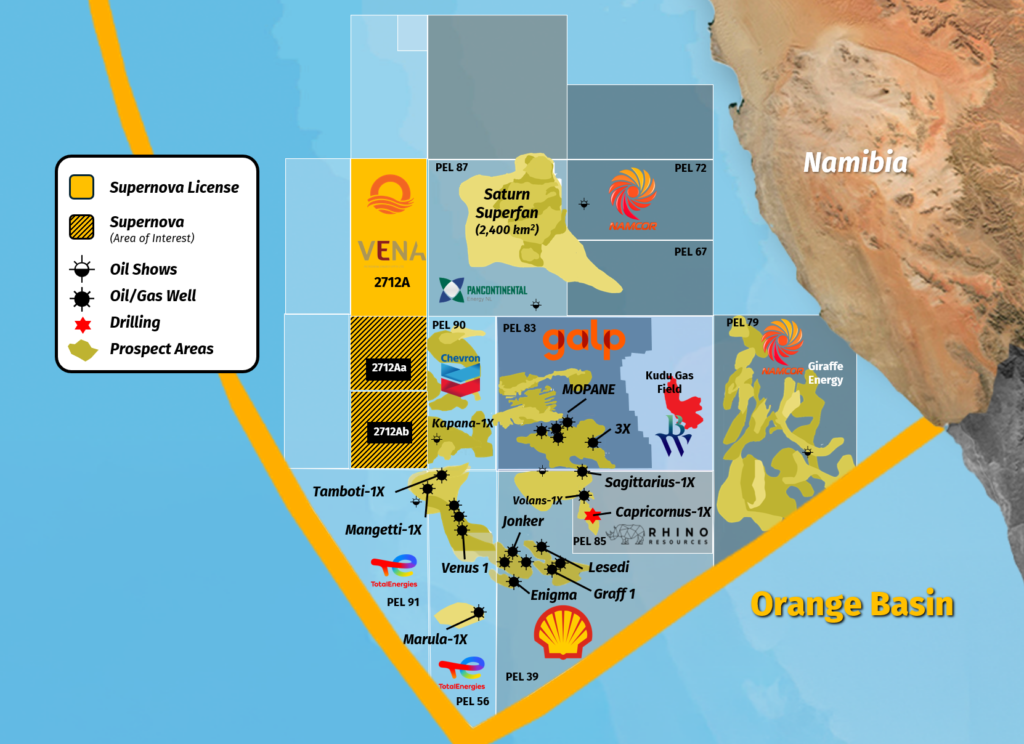

Major discoveries: Positioned next to Shell, TotalEnergies, and Galp in one of the world’s hottest oil frontiers.

CSE: SUPR | FSE: A1S

Be Part of the Next Breakout Oil Story in Namibia’s Orange Basin

CSE: SUPR | FSE: A1S

Be the first to receive technical reports, partner announcements, drilling updates, and investor presentations.

Namibia’s offshore Orange Basin is experiencing an unprecedented surge in exploration activity, rapidly evolving into a globally significant oil frontier. For investors, this represents an exceptional early-stage opportunity in a region poised for substantial growth.

Global Oil Demand Rising

Despite the global energy transition, the International Energy Agency forecasts oil demand growth of over 1 million barrels/day in 2025, emphasizing continued reliance on new discoveries.

Fair and Stable Government Commercial Terms

Government actively supports fast-tracking oil and gas developments.

Limited Blocks Available

Few junior exploration companies have secured positions, increasing potential competition and driving up asset values.

Namibia has rapidly become one of the world’s most exciting oil exploration regions, capturing global attention with substantial recent offshore discoveries. In just the past few years, Namibia’s offshore basins—particularly the Orange Basin—have emerged as some of the most promising and under-explored petroleum systems on the planet, closely mirroring the transformational oil discoveries recently seen in Guyana.

Total offshore reserves in Namibia are currently estimated to be around 20 billion barrels of oil, reflecting the tremendous exploration success achieved by some of the world’s leading oil majors.

TotalEnergies Venus-1X:

~5.1 billion barrels

(Africa’s largest-ever Sub-Saharan find)

Shell Graff-1X:

~2.38 billion barrels

Shell Jonker-1X:

~2.5 billion barrels

Galp Mopane Field:

~10 billion barrels oil equivalent (oil & gas)

Low Valuation:

Expert Team:

Ideal TIming:

Tier-One Neighbours:

Near-Term Newsflow:

Low Valuation:

Expert Team:

Ideal TIming:

Tier-One Neighbours:

Near-Term Newsflow:

Corporate Video

Market Cap: CAD $227.7 m

Market Cap: AUD $130.2 m

Market Cap: CAD $12.5 m

Market Cap: CAD $227.7 m

Market Cap: AUD $130.2 m

Market Cap: CAD $12.5 m

Be the first to receive technical reports, partner announcements, drilling updates, and investor presentations.